SUWANEE, Ga., Aug. 14, 2018 (GLOBE NEWSWIRE) — SANUWAVE Health, Inc. (OTCQB: SNWV) reported financial results for the three months ended June 30, 2018 with the SEC on Tuesday, August 14, 2018 and will provide a business update on a conference call today, August 14, 2018 at 10:00 a.m. Eastern Time.

Highlights of the second quarter and recent weeks:

- Record revenue for the second quarter of 2018 was $453,210, up 308% from the second quarter of 2017.

- The Company named Shri Parikh President of SANUWAVE’s Global Healthcare division.

- The Company entered into an agreement with Johnfk Medical Inc. (“FKS”), pursuant to which the Company and FKS will enter into a joint venture for the manufacture, sale and distribution of the Company’s dermaPACE® and orthoPACE® devices covering 11 countries in Southeast Asia. The initial payment per the agreement has been received, initial orders have been shipped in Q3 and this agreement is expected to drive significant growth in the near term.

- The Company signed a binding term sheet for a joint venture with Tarbaca Lightning covering 3 countries in Central America.

- The Company appointed Dr. Perry Mayer, Medical Director and principal at The Mayer Institute in Hamilton, Ontario, Canada, to its Clinical Advisory Board.

- The Company appointed AMBIENSYS SRL as its distributor for dermaPACE in Romania. The initial orders have been shipped and training successfully occurred in Q2.

- Third quarter medical conference attendance activity for the Company is expected to be a record eight meetings.

- Perfusion case study kicked off in July with Rutgers, UCLA, and Northwestern University. We anticipate full results from this clinical work to be released in early 2019.

Since the FDA clearance, we have begun to develop and implement a platform for rolling out the dermaPACE System for treating DFU’s in the US. We are taking a methodical approach to the roll out to ensure we ultimately achieve our goal – the delivery of a dermaPACE System to any location in the US that will be treating DFU’s. As we have stated on prior calls, we have five goals for 2018 which will deliver accelerating growth throughout the year and establish the platform for continued growth in 2019 and beyond as we penetrate the US and global wound care market. The goals for 2018 remain:

- Initial revenue in the U.S.

- Expand senior management team in U.S. wound market

- Enter 4 new international markets

- Begin supportive clinical work

- Expansion of Board of Directors and Science Advisory Board

We are well on track to achieve or exceed all the goals we established for 2018 and this translates to revenue increases throughout the year. As we hire experienced senior managers in the areas of Reimbursement, Clinical, and Sales, we anticipate revenue expansion occurring in the US toward the end of 2018 building a strong foundation to deliver substantial domestic revenue in 2019.

Second Quarter Financial Results

Revenues for the three months June 30, 2018 were $453,210, compared to $111,045 for the same period in 2017, an increase of $342,165, or 308%. Revenues resulted primarily from sales in the United States and Europe of our dermaPACE and orthoPACE devices and related applicators. The increase in revenues for 2018 was due to the higher sale of devices and both new and refurbished applicators in the United States and Europe as compared to the same period in 2017.

Research and development expenses for the three months ended June 30, 2018 were $368,377, compared to $437,909 for the same period in 2017, a decrease of $69,572, or 16%. The decrease in research and development expenses was due to lower stock-based compensation expense and to lower consultant costs related to the FDA submission and follow up which was partially offset by the hiring of a full-time software engineers and an accrual of bonus for 2018.

General and administrative expenses for the three months ended June 30, 2018 were $2,030,799, as compared to $951,908 for the same period in 2017, an increase of $1,078,891, or 113%. The increase in general and administrative expenses was due to the hiring of a president and human resources director and the related stock-based compensation expense for stock options issued, higher travel costs, accrual of bonus, higher public company costs related to investor relations, higher costs related to leasing of product, and higher consultant fees related to the commercialization of the dermaPACE System.

Net loss for the three months ended June 30, 2018 was $2,888,259, or ($0.02) per basic and diluted share, compared to a net loss of $1,415,937, or ($0.01) per basic and diluted share, for the same period in 2017, an increase in the net loss of $1,472,322. The increase in the net loss for 2018 was primarily due to higher general and administrative expenses as noted above as well as higher interest expense related to convertible promissory notes which was partially offset by gain on warrant valuation adjustment.

We anticipate that our operating losses will continue over the next few years as we incur expenses related to commercialization of our dermaPACE system for the treatment of diabetic foot ulcers in the United States. If we are able to successfully commercialize, market and distribute the dermaPACE system, we hope to partially or completely offset these losses in the future.

Six Months ended June 30, 2018 Financial Results

Revenues for the six months June 30, 2018 were $797,482, compared to $260,614 for the same period in 2017, an increase of $536,868, or 206%. Revenues resulted primarily from sales in the United States and Europe of our dermaPACE and orthoPACE devices and related applicators. The increase in revenues for 2018 was due to the higher sale of devices and both new and refurbished applicators in the United States and Europe as compared to the same period in 2017.

Research and development expenses for the six months ended June 30, 2018 were $717,781, compared to $698,247 for the same period in 2017, an increase of $19,534, or 3%. The increase in research and development expenses was due to the hiring of two full-time software engineers, stock-based compensation expense for stock options issued, accrual of bonus, and consulting fees related to reimbursement strategy which was partially offset by lower consultant costs related to the FDA submission and follow up.

General and administrative expenses for the six months ended June 30, 2018 were $2,976,405, as compared to $1,400,514 for the same period in 2017, an increase of $1,575,891, or 113%. The increase in general and administrative expenses was due to the hiring of a president and human resources director and the related stock-based compensation expense for stock options issued, higher travel costs, accrual of bonus, recruiting fees for open positions, higher legal and accounting fees related to SEC filings and higher consultant fees related to the commercialization of the dermaPACE System.

Net loss for the six months ended June 30, 2018 was $8,744,914, or ($0.06) per basic and diluted share, compared to a net loss of $1,909,469, or ($0.01) per basic and diluted share, for the same period in 2017, an increase in the net loss of $6,835,445. The increase in the net loss for 2018 was primarily due to higher general and administrative expenses as noted above as well as higher interest expense related to convertible promissory notes and loss on warrant valuation adjustment.

Cash and cash equivalents decreased by $59,470 for the six months ended June 30, 2018 and decreased by $71,502 for the six months ended June 30, 2017. For the six months ended June 30, 2018 and 2017, net cash used by operating activities was $1,598,202 and $572,492, respectively, primarily consisting of compensation costs, research and development activities and general corporate operations. The increase of $1,025,710 in the use of cash for operating activities for the six months ended June 30, 2018, as compared to the same period for 2017, was primarily due to the increased operating expenses and decreased payables in 2018. Net cash used by investing activities for the six months ended June 30, 2018 consisted of purchase of property and equipment of $13,612. Net cash provided by financing activities for the six months ended June 30, 2018 was $1,563,313, which consisted of $1,159,785 from the issuance of convertible promissory notes, $38,528 from the exercise of warrants, $136,000 net increase in line of credit, $85,000 from the issuance of short term notes payable and $144,000 from an advance from related party. Net cash provided by financing activities for the six months ended June 30, 2017 was $514,757, which consisted of $421,690 from advances from related parties and $93,067 from exercise of warrants.

“During the second quarter we continued to meet our objectives for 2018 by signing 3 international deals, hiring Shri Parikh to lead the healthcare group, adding science advisor in Dr. Perry Mayer, and kicking off clinical work to support sales domestically,” stated Kevin A. Richardson II, Chairman of the Board of SANUWAVE. “We expect continued growth over last year as we continue to market our products both domestically and abroad,” concluded Mr. Richardson.

Conference Call

The Company will host a conference call on Tuesday, August 14, 2018, beginning at 10AM Eastern Time to discuss the second quarter financial results, provide a business update and answer questions.

Shareholders and other interested parties can participate in the conference call by dialing 877-407-8033 (U.S.) or 201-689-8033 (international) or via webcast at http://www.investorcalendar.com/event/36506.

A replay of the conference call will be available beginning two hours after its completion through August 28, 2018, by dialing 877-481-4010 (U.S.) or 919-882-2331 and entering PIN 36506 and a replay of the webcast will be available at http://www.investorcalendar.com/event/36506 until November 14, 2018.

About SANUWAVE Health, Inc.

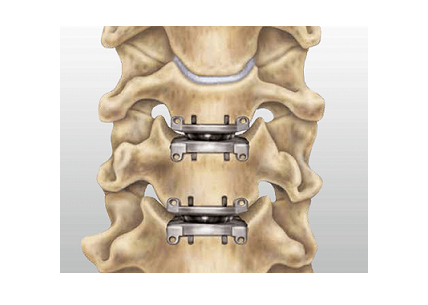

SANUWAVE Health, Inc. (www.sanuwave.com) is a shock wave technology company initially focused on the development and commercialization of patented noninvasive, biological response activating devices for the repair and regeneration of skin, musculoskeletal tissue and vascular structures. SANUWAVE’s portfolio of regenerative medicine products and product candidates activate biologic signaling and angiogenic responses, producing new vascularization and microcirculatory improvement, which helps restore the body’s normal healing processes and regeneration. SANUWAVE applies its patented PACE® technology in wound healing, orthopedic/spine, plastic/cosmetic and cardiac conditions. Its lead product candidate for the global wound care market, dermaPACE®, received US FDA clearance in December 2017 for the treatment of Diabetic Foot Ulcers. dermaPACE is the only Extracorporeal Shockwave Technology (ESWT) device cleared or approved in the US for the treatment of DFUs. Internationally, dermaPACE is CE Marked throughout Europe and has device license approval for the treatment of the skin and subcutaneous soft tissue in Canada, Australia and New Zealand, and South Korea. SANUWAVE researches, designs, manufactures, markets and services its products worldwide, and believes it has demonstrated that its technology is safe and effective in stimulating healing in chronic conditions of the foot (plantar fasciitis) and the elbow (lateral epicondylitis) through its U.S. Class III PMA approved OssaTron® device, as well as stimulating bone and chronic tendonitis regeneration in the musculoskeletal environment through the utilization of its OssaTron, Evotron® and orthoPACE® devices in Europe, Asia and Asia/Pacific. In addition, there are license/partnership opportunities for SANUWAVE’s shock wave technology for non-medical uses, including energy, water, food and industrial markets.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to financial results and plans for future business development activities, and are thus prospective. Forward-looking statements include all statements that are not statements of historical fact regarding intent, belief or current expectations of the Company, its directors or its officers. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the Company’s ability to control. Actual results may differ materially from those projected in the forward-looking statements. Among the key risks, assumptions and factors that may affect operating results, performance and financial condition are risks associated with the regulatory approval and marketing of the Company’s product candidates and products, unproven pre-clinical and clinical development activities, regulatory oversight, the Company’s ability to manage its capital resource issues, competition, and the other factors discussed in detail in the Company’s periodic filings with the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statement.

For additional information about the Company, visit www.sanuwave.com.

Contact:

Millennium Park Capital LLC

Christopher Wynne

312-724-7845

cwynne@mparkcm.com

SANUWAVE Health, Inc.

Kevin Richardson II

CEO & Chairman

978-922-2447

investorrelations@sanuwave.com

(FINANCIAL TABLES FOLLOW)

|

|

|

|

|

|

|

|

|

|

SANUWAVE HEALTH, INC. AND SUBSIDIARIES |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

| |

(UNAUDITED) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

ASSETS |

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

670,714 |

|

|

$ |

730,184 |

|

|

|

Accounts receivable, net of allowance for doubtful accounts |

|

|

144,330 |

|

|

|

152,520 |

|

|

|

Contract assets |

|

|

|

40,000 |

|

|

|

– |

|

|

|

Inventory, net of losses and obsolescence |

|

|

|

216,316 |

|

|

|

231,532 |

|

|

|

Prepaid expenses |

|

|

|

144,816 |

|

|

|

90,288 |

|

|

|

TOTAL CURRENT ASSETS |

|

|

|

1,216,176 |

|

|

|

1,204,524 |

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT, net |

|

|

|

59,787 |

|

|

|

60,369 |

|

|

|

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

|

17,789 |

|

|

|

13,917 |

|

|

|

TOTAL ASSETS |

|

|

$ |

1,293,752 |

|

|

$ |

1,278,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

Accounts payable |

|

|

$ |

951,034 |

|

|

$ |

1,496,523 |

|

|

|

Accrued expenses |

|

|

|

966,984 |

|

|

|

673,600 |

|

|

|

Accrued employee compensation |

|

|

|

195,874 |

|

|

|

1,680 |

|

|

|

Contract liabilities |

|

|

|

491,055 |

|

|

|

– |

|

|

|

Advances from related and unrelated parties |

|

|

|

144,000 |

|

|

|

310,000 |

|

|

|

Line of credit, related parties |

|

|

|

517,279 |

|

|

|

370,179 |

|

|

|

Convertible promissory notes, net |

|

|

|

2,648,548 |

|

|

|

455,606 |

|

|

|

Short term notes payable |

|

|

|

85,041 |

|

|

|

– |

|

|

|

Interest payable, related parties |

|

|

|

842,653 |

|

|

|

685,907 |

|

|

|

Warrant liability |

|

|

|

3,637,207 |

|

|

|

1,943,883 |

|

|

|

Notes payable, related parties, net |

|

|

|

5,297,743 |

|

|

|

5,222,259 |

|

|

|

TOTAL CURRENT LIABILITIES |

|

|

|

15,777,418 |

|

|

|

11,159,637 |

|

|

|

|

|

|

|

|

|

|

|

| NON-CURRENT LIABILITIES |

|

|

|

|

|

|

|

Contract liabilities |

|

|

|

76,500 |

|

|

|

– |

|

|

|

TOTAL NON-CURRENT LIABILITIES |

|

|

|

76,500 |

|

|

|

– |

|

|

|

TOTAL LIABILITIES |

|

|

|

15,853,918 |

|

|

|

11,159,637 |

|

|

|

|

|

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

| PREFERRED STOCK, SERIES A CONVERTIBLE, par value $0.001, |

|

|

|

|

|

|

6,175 authorized; 6,175 shares issued and 0 shares outstanding |

|

|

|

|

|

|

in 2017 and 2016 |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED STOCK, SERIES B CONVERTIBLE, par value $0.001, |

|

|

|

|

|

|

293 authorized; 293 shares issued and 0 shares outstanding |

|

|

|

|

|

|

in 2017 and 2016, respectively |

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED STOCK – UNDESIGNATED, par value $0.001, 4,993,532 |

|

|

|

|

|

|

shares authorized; no shares issued and outstanding |

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK, par value $0.001, 350,000,000 shares authorized; |

|

|

|

|

|

|

151,852,757 and 139,300,122 issued and outstanding in 2018 and |

|

|

|

|

|

|

2017, respectively |

|

|

|

151,853 |

|

|

|

139,300 |

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL PAID-IN CAPITAL |

|

|

|

99,059,031 |

|

|

|

94,995,040 |

|

|

|

|

|

|

|

|

|

|

|

| ACCUMULATED DEFICIT |

|

|

|

(113,716,298 |

) |

|

|

(104,971,384 |

) |

|

|

|

|

|

|

|

|

|

|

| ACCUMULATED OTHER COMPREHENSIVE LOSS |

|

|

(54,752 |

) |

|

|

(43,783 |

) |

|

|

TOTAL STOCKHOLDERS’ DEFICIT |

|

|

|

(14,560,166 |

) |

|

|

(9,880,827 |

) |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

1,293,752 |

|

|

$ |

1,278,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANUWAVE HEALTH, INC. AND SUBSIDIARIES |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS |

|

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Six Months Ended |

|

Six Months Ended |

|

| |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUES |

|

$ |

453,210 |

|

|

$ |

111,045 |

|

|

$ |

797,482 |

|

|

$ |

260,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUES (exclusive of depreciation shown below) |

|

|

166,643 |

|

|

|

24,695 |

|

|

|

332,109 |

|

|

|

79,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

368,337 |

|

|

|

437,909 |

|

|

|

717,781 |

|

|

|

698,247 |

|

|

|

General and administrative |

|

|

2,030,799 |

|

|

|

951,908 |

|

|

|

2,976,405 |

|

|

|

1,400,514 |

|

|

|

Depreciation |

|

|

6,008 |

|

|

|

5,958 |

|

|

|

11,024 |

|

|

|

12,078 |

|

|

|

Loss on sale of property and equipment |

|

|

3,170 |

|

|

|

– |

|

|

|

3,170 |

|

|

|

– |

|

|

|

|

TOTAL OPERATING EXPENSES |

|

|

2,408,314 |

|

|

|

1,395,775 |

|

|

|

3,708,380 |

|

|

|

2,110,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS |

|

|

(2,121,747 |

) |

|

|

(1,309,425 |

) |

|

|

(3,243,007 |

) |

|

|

(1,930,064 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

Gain (loss) on warrant valuation adjustment |

|

|

1,161,520 |

|

|

|

35,410 |

|

|

|

(1,812,162 |

) |

|

|

358,633 |

|

|

|

Interest expense, net |

|

|

(1,929,755 |

) |

|

|

(143,281 |

) |

|

|

(3,674,722 |

) |

|

|

(336,019 |

) |

|

|

Gain (loss) on foreign currency exchange |

|

|

1,723 |

|

|

|

1,359 |

|

|

|

(15,023 |

) |

|

|

(2,019 |

) |

|

|

|

TOTAL OTHER INCOME (EXPENSE), NET |

|

|

(766,512 |

) |

|

|

(106,512 |

) |

|

|

(5,501,907 |

) |

|

|

20,595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

|

|

(2,888,259 |

) |

|

|

(1,415,937 |

) |

|

|

(8,744,914 |

) |

|

|

(1,909,469 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(11,904 |

) |

|

|

(15,552 |

) |

|

|

(10,969 |

) |

|

|

(13,767 |

) |

|

|

|

TOTAL COMPREHENSIVE LOSS |

|

$ |

(2,900,163 |

) |

|

$ |

(1,431,489 |

) |

|

$ |

(8,755,883 |

) |

|

$ |

(1,923,236 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS PER SHARE: |

|

|

|

|

|

|

|

|

|

|

Net loss – basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic and diluted |

|

|

148,582,386 |

|

|

|

138,992,669 |

|

|

|

144,168,215 |

|

|

|

138,517,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANUWAVE HEALTH, INC. AND SUBSIDIARIES |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

Six Months Ended |

|

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

| Net loss |

|

|

$ |

(8,744,914 |

) |

|

$ |

(1,909,469 |

) |

|

| Adjustments to reconcile loss from continuing operations |

|

|

|

|

|

|

| to net cash used by operating activities |

|

|

|

|

|

|

|

Depreciation |

|

|

|

11,024 |

|

|

|

12,078 |

|

|

|

Change in allowance for doubtful accounts |

|

|

|

(61,344 |

) |

|

|

116,833 |

|

|

|

Stock-based compensation – employees, directors and advisors |

|

|

|

836,796 |

|

|

|

482,295 |

|

|

|

Loss (gain) on warrant valuation adjustment |

|

|

|

1,812,162 |

|

|

|

(358,633 |

) |

|

|

Amortization of debt issuance costs |

|

|

|

2,683,936 |

|

|

|

– |

|

|

|

Amortization of debt discount |

|

|

|

75,484 |

|

|

|

57,349 |

|

|

|

Stock issued for consulting services |

|

|

|

106,500 |

|

|

|

– |

|

|

|

Warrants issued for consulting services |

|

|

|

737,457 |

|

|

|

– |

|

|

|

Loss on sale of fixed assets |

|

|

|

3,170 |

|

|

|

– |

|

|

|

Changes in assets – (increase)/decrease |

|

|

|

|

|

|

|

Accounts receivable – trade |

|

|

|

69,534 |

|

|

|

152,034 |

|

|

|

Inventory |

|

|

|

15,216 |

|

|

|

33,175 |

|

|

|

Prepaid expenses |

|

|

|

(54,528 |

) |

|

|

(7,918 |

) |

|

|

Contract assets |

|

|

|

(40,000 |

) |

|

|

– |

|

|

|

Other |

|

|

|

(3,872 |

) |

|

|

(191 |

) |

|

|

Changes in liabilities – increase/(decrease) |

|

|

|

|

|

|

|

Accounts payable |

|

|

|

(425,489 |

) |

|

|

475,495 |

|

|

|

Accrued expenses |

|

|

|

91,459 |

|

|

|

95,497 |

|

|

|

Accrued employee compensation |

|

|

|

194,194 |

|

|

|

294 |

|

|

|

Contract liabilities |

|

|

|

769,480 |

|

|

|

– |

|

|

|

Accrued interest |

|

|

|

168,787 |

|

|

|

– |

|

|

|

Interest payable, related parties |

|

|

|

156,746 |

|

|

|

278,669 |

|

|

| |

NET CASH USED BY OPERATING ACTIVITIES |

|

|

|

(1,598,202 |

) |

|

|

(572,492 |

) |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

|

(13,612 |

) |

|

|

– |

|

|

| |

NET CASH USED BY INVESTING ACTIVITIES |

|

|

|

(13,612 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

Proceeds from convertible promissory notes, net |

|

|

|

1,159,785 |

|

|

|

– |

|

|

|

Proceeds from line of credit, related party |

|

|

|

280,500 |

|

|

|

– |

|

|

|

Advances from related parties |

|

|

|

156,000 |

|

|

|

421,690 |

|

|

|

Proceeds from note payable, product |

|

|

|

96,708 |

|

|

|

– |

|

|

|

Proceeds from short term note |

|

|

|

85,000 |

|

|

|

– |

|

|

|

Proceeds from warrant exercise |

|

|

|

38,528 |

|

|

|

93,067 |

|

|

|

Payment on line of credit, related party |

|

|

|

(144,500 |

) |

|

|

– |

|

|

|

Payments on note payable, product |

|

|

|

(96,708 |

) |

|

|

– |

|

|

|

Payments on advances from related parties |

|

|

|

(12,000 |

) |

|

|

– |

|

|

| |

NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

|

|

1,563,313 |

|

|

|

514,757 |

|

|

|

|

|

|

|

|

|

|

| EFFECT OF EXCHANGE RATES ON CASH |

|

|

|

(10,969 |

) |

|

|

(13,767 |

) |

|

|

|

|

|

|

|

|

|

| |

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

|

|

(59,470 |

) |

|

|

(71,502 |

) |

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

|

|

|

730,184 |

|

|

|

133,571 |

|

|

| |

CASH AND CASH EQUIVALENTS, END OF PERIOD |

|

|

$ |

670,714 |

|

|

$ |

62,069 |

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL INFORMATION |

|

|

|

|

|

|

|

Cash paid for interest, related parties |

|

|

$ |

151,227 |

|

|

$ |

– |

|

|

|

Cash paid for note payable, product |

|

|

$ |

96,708 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

| NONCASH INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

Stock issued for services |

|

|

$ |

106,500 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

|

Cashless exercise of warrants |

|

|

$ |

118,838 |

|

|

$ |

56,740 |

|

|

|

|

|

|

|

|

|

|

|

Advances from related and unrelated parties converted to Convertible promissory notes |

|

$ |

310,000 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable converted to Convertible promissory notes |

|

|

$ |

120,000 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

|

Beneficial conversion feature on 10% convertible promissory notes |

|

|

|

709,827 |

|

|

|

– |

|

|

|

Beneficial conversion feature on convertible promissory note |

|

|

|

35,396 |

|

|

|

– |

|

|

|

Beneficial conversion feature on convertible debt |

|

|

$ |

745,223 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued with 10% convertible promissory notes |

|

|

$ |

808,458 |

|

|

$ |

– |

|

|

|

Warrants issued with convertible promissory note |

|

|

|

36,104 |

|

|

|

– |

|

|

|

Warrants issued for debt |

|

|

$ |

844,562 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|

|

Conversion of 10% convertible promissory notes |

|

|

$ |

631,000 |

|

|

$ |

– |

|

|

|

|

|

|

|

|

|

|