September 1, 2016 – By Carolyn LaWell

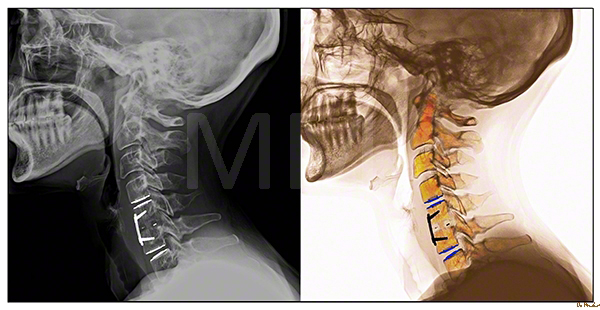

Disc Replacement

Zimmer Biomet’s $1 billion acquisition of LDR and its Mobi-C cervical disc assets and Medtronic’s FDA Premarket Approval for the Prestige LP 2-level application changed the game in the U.S. 2-level cervical disc replacement arena.

Mobi-C had been the only 2-level disc approved on the U.S. market. Prior to Zimmer Biomet’s purchase of the technology, LDR was able to expand reimbursement coverage, update label claims and publish peer-reviewed papers that resulted in Mobi-C’s sales growth, which increased 80% in 2015 vs. 2014.

Further, in April 2016, LDR reported that Mobi-C had surpassed $100 million in cumulative U.S. revenue since its 2013 launch. Half of the Mobi-C units sold address 1-level indications and half are for 2-level indications.

The acquisition of LDR allows Zimmer Biomet to increase its share of the worldwide spine market from 4% to 5%, according to ORTHOWORLD estimates. While the purchase also expands Zimmer Biomet’s traditional cervical and lumbar offerings, Mobi-C is presumably the technology that attracted Zimmer Biomet to LDR, primarily.

Medtronic’s entry into the 2-level market is expected to put competitive pressure on Zimmer Biomet’s purchase. The 2-level discs will be sold in a small market that faces a lack of reimbursement, compared to 1-level discs and fusion. To dive into specifics, >50 million lives are covered for Mobi-C’s 2-level procedure. The total artificial disc market is expected to reach ~$275 million in 2016, according to estimates in the ORTHOWORLD report, Cervical and Lumbar Artificial Disc Profiles.