LEESBURG, Va., Oct. 10, 2018 (GLOBE NEWSWIRE) — K2M Group Holdings, Inc. (NASDAQ:KTWO) (the “Company” or “K2M”), a global leader of complex spine and minimally invasive solutions focused on achieving three-dimensional Total Body Balance™, today announced at the Scoliosis Research Society 53rd Annual Meeting & Course, in Bologna, Italy a U.S. Food and Drug Administration (FDA) 510(k) clearance that also provides for the Dual Differential Correction (DDC™) Philosophy & Technique. The DDC philosophy combines rod rigidity and degree of bend with the MESA® Platform Technology, to help achieve quality outcomes in patients with sagittal imbalance. In addition, MESA can be used with the BACS® Patient-Specific Rods to help surgeons create pre-contoured rods, rails, and templates that match the surgeon’s preoperative plan.

Todd Ritzman, MD, Akron Children’s Hospital, explained, “Given the growing recognition of the importance of sagittal plane correction in idiopathic scoliosis, it is a valuable aid to objectively determine rod contour based off of a given patient’s pelvic incidence to help optimize surgical correction in the sagittal plane. The days of ‘eyeballing’ the rod contour are over.”

K2M’s MESA Platform Technology features top-loading and low-profile screws and Zero-Torque Technology® that one-step locks without applying torsional stress to the spine. The MESA Platform includes the MESA 2 Deformity Spinal System, a state-of-the-art solution for the most difficult correction maneuvers in complex spine surgery.

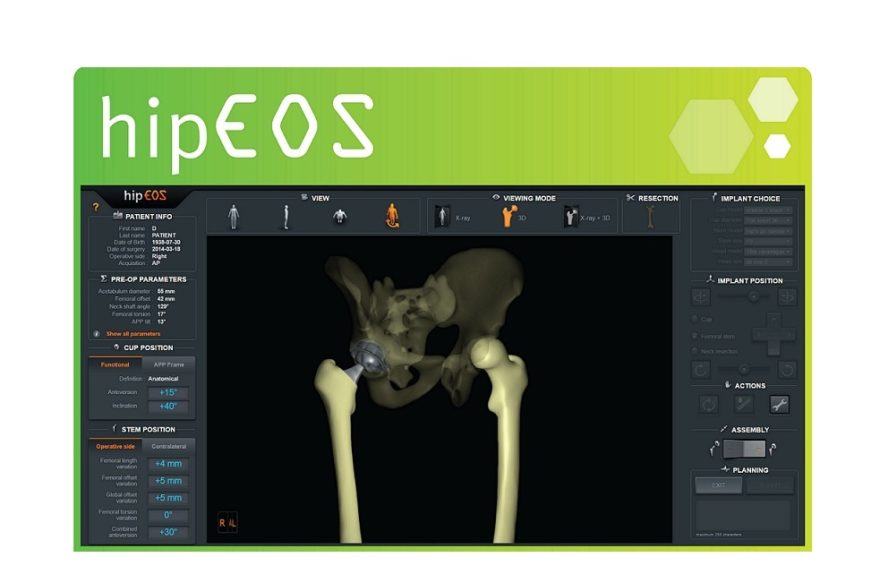

K2M manufactures BACS Patient-Specific Rods and Rails using a machine rolling method, replacing the manual three-point bending method that often reduces rod fatigue strength. By incorporating data from BACS Surgical Planner—part of K2M’s comprehensive BACS Digital Platform— rods and rails can be manufactured with complex multi-contoured designs. BACS Patient-Specific Rods and Rails can be used with the MESA, EVEREST®, and DENALI® Spinal Systems.

BACS provides solutions focused on achieving balance of the spine by addressing each anatomical vertebral segment with a 360-degree approach to the axial, coronal, and sagittal planes, emphasizing Total Body Balance as an important component of surgical success.

K2M to Appear at SRS 2018

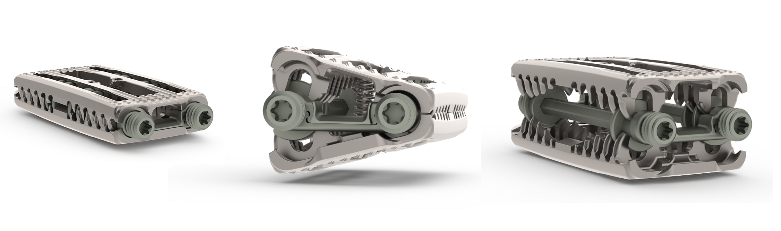

At the meeting, K2M executives will be onsite to discuss the Company’s differentiated spinal solutions, including its MESA Platform Technology, 3D-printed devices featuring Lamellar 3D Titanium Technology™, and comprehensive Balance ACS® (BACS) Platform.

“K2M is a proud Double Diamond Sponsor of SRS 2018,” said John P. Kostuik, MD, Chief Medical Officer, Co-founder, and Member of the Board of Directors at K2M, and Past President of the SRS. “This year, we are excited to build upon our culture of innovation by showcasing our leading spinal solutions, most notably our Dual Differential Correction Philosophy & Technique—used in conjunction with our world-class MESA Platform Technology and Balance ACS Platform—so surgeons can correct complex spinal deformities across all three anatomical planes and help eliminate the need for further derotation maneuvers.”

For more information on K2M and Balance ACS, visit www.K2M.com and www.BACS.com.

About K2M

K2M Group Holdings, Inc. is a global leader of complex spine and minimally invasive solutions focused on achieving three-dimensional Total Body Balance. Since its inception, K2M has designed, developed, and commercialized innovative complex spine and minimally invasive spine technologies and techniques used by spine surgeons to treat some of the most complicated spinal pathologies. K2M has leveraged these core competencies into Balance ACS, a platform of products, services, and research to help surgeons achieve three-dimensional spinal balance across the axial, coronal, and sagittal planes, with the goal of supporting the full continuum of care to facilitate quality patient outcomes. The Balance ACS platform, in combination with the Company’s technologies, techniques and leadership in the 3D-printing of spinal devices, enable K2M to compete favorably in the global spinal surgery market. For more information, visit www.K2M.com and connect with us on Facebook, Twitter, Instagram, LinkedIn and YouTube.

Forward-Looking Statements

The foregoing contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We intend for these forward-looking statements to be covered by the safe harbor provisions of the federal securities laws relating to forward-looking statements. These forward-looking statements include statements relating to the expected timing, completion and effects of the proposed merger, as well as other statements representing management’s beliefs about, future events, transactions, strategies, operations and financial results, including, without limitation, our expectations with respect to the costs and other anticipated financial impacts of the merger; future financial and operating results of K2M Group Holdings, Inc. (“K2M”); K2M’s plans, objectives, expectations and intentions with respect to future operations and services; required approvals to complete the merger by our stockholders and by governmental regulatory authorities, and the timing and conditions for such approvals; the stock price of K2M prior to the consummation of the transactions; and the satisfaction of the closing conditions to the proposed merger. Such forward-looking statements often contain words such as “assume,” “will,” “anticipate,” “believe,” “predict,” “project,” “potential,” “contemplate,” “plan,” “forecast,” “estimate,” “expect,” “intend,” “is targeting,” “may,” “should,” “would,” “could,” “goal,” “seek,” “hope,” “aim,” “continue” and other similar words or expressions or the negative thereof or other variations thereon. Forward-looking statements are made based upon management’s current expectations and beliefs and are not guarantees of future performance. Such forward-looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements. Our actual business, financial condition or results of operations may differ materially from those suggested by forward-looking statements as a result of risks and uncertainties which include, among others, those risks and uncertainties described in any of our filings with the Securities and Exchange Commission (the “SEC”). Certain other factors which may impact our business, financial condition or results of operations or which may cause actual results to differ from such forward-looking statements are discussed or included in our periodic reports filed with the SEC and are available on our website at www.K2M.com under “Investor Relations.” You are urged to carefully consider all such factors. Although it is believed that the expectations reflected in such forward-looking statements are reasonable and are expressed in good faith, such expectations may not prove to be correct and persons reading this communication are therefore cautioned not to place undue reliance on these forward-looking statements which speak only to expectations as of the date of this communication. We do not undertake or plan to update or revise forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances occurring after the date of this communication, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. If we make any future public statements or disclosures which modify or impact any of the forward-looking statements contained in or accompanying this communication, such statements or disclosures will be deemed to modify or supersede such statements in this communication.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. In connection with this proposed acquisition, K2M has filed a definitive proxy statement and has filed or may file other documents with the SEC. This communication is not a substitute for any proxy statement or other document K2M has filed or may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF K2M ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT HAVE BEEN (OR MAY BE) FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The definitive proxy statement will be mailed to stockholders of K2M. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by K2M through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by K2M will be available free of charge on K2M’s internet website at www.K2M.com or upon written request to: Secretary, K2M Group Holdings, Inc., 600 Hope Parkway, SE, Leesburg, Virginia 20175, or by telephone at (703) 777-3155.

Participants in Solicitation

K2M, its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in such solicitation in connection with the proposed merger will be set forth in the definitive proxy statement filed with the SEC on October 5, 2018. Information about the directors and executive officers of K2M is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on March 1, 2018, its proxy statement for its 2018 annual meeting of stockholders, which was filed with the SEC on April 20, 2018, its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2018 and June 30, 2018, which were filed with the SEC on May 2, 2018 and August 2, 2018, respectively, and its Current Reports on Form 8-K or Form 8-K/A, which were filed with the SEC on January 8, 2018, January 9, 2018, February 28, 2018, March 29, 2018, May 1, 2018, June 11, 2018, June 14, 2018, June 18, 2018, August 1, 2018, August 30, 2018, and October 5, 2018.

These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive proxy statement and other relevant materials filed with the SEC.

K2M Group Holdings, Inc.

600 Hope Parkway, SE

Leesburg, Virginia 20175

Tel. (703) 777-3155

www.K2M.com

Media Contact:

Zeno Group on behalf of K2M Group Holdings, Inc.

Christian Emering, 212-299-8985

Christian.Emering@ZenoGroup.com

Investor Contact:

Westwicke Partners on behalf of K2M Group Holdings, Inc.

Mike Piccinino, CFA, 443-213-0500

K2M@westwicke.com